Capella Resources Ltd.

Capella Resources Ltd. (Bid $1.18/ Offer $1.21)

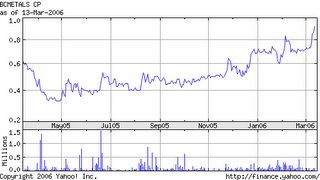

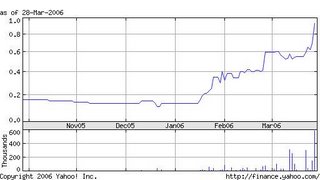

The meteoric rise of Capella Resources based on the agreement in principle with International Minerals Resources Ltd (IMR) to acquire all issued and outstanding shares and capital of Compania Minera Cerro El Diablo Inc. (CMCD). The assets being acquired are made up of a 100% interest in the Nevada and Dorado gold properties located in the Copiapo area of Northen Chile.

Furthermore, a firm called Blackmont Capital Inc. will attempt to do a private placement for upto 3 million dollars to fund working capital and exploration.

The question here is should this news release merit the sharp run up in the price of this stock over the month of march from $0.40 to its current level of $1.21.

Well, Capella is a company that is primarily owned and operated by the Gracey's and their associates. Capella Resources Ltd. is basically a shell. What the investor's in the shell company want to see happen is that a promoter will come on baord, promote an idea for the company and run up the price making all the insiders and those that have gotten in on previous private placement, at pennies a share necessary in the past to raise money and keep the company listed, rich. That is a bit of a run on sentence but that is how it works. That having been said, this doesn't necessarily mean that a mine or a discovery is not possible, but at this stage the price premium seems far to high to merit buying this stock at its current price. If you do you will be enriching the pockets of those already in and you will, in all likelyhood reap very little or no benefit. Buyer beware.

One other thing to note is that a very large portion of this issue in controlled by a very small group of investors. You might call them Gracey and assosciates. They know how the game si played and have done very well playing it. When they want to get out a lot of stock will get dumped on the market. I suggest that if you want to play this game look for shell companies that are dormant and cost pennies per share. Time will tell but you are better off buying a shell company before the action starts rather than afterit has risen a dollar.